BTC Price Prediction: Analyzing the Path to $200,000 Amid Technical Strength and Fundamental Catalysts

#BTC

- Technical Strength: Bitcoin trading above 20-day MA with Bollinger Bands suggesting controlled volatility and room for upward movement

- Fundamental Catalysts: Fed rate cuts, institutional accumulation, and growing global adoption creating favorable macroeconomic conditions

- Market Dynamics: Supply shock potential from exchange reserves and long-term holder distribution balanced by strong institutional demand

BTC Price Prediction

Technical Analysis: Bitcoin Shows Bullish Momentum Above Key Moving Average

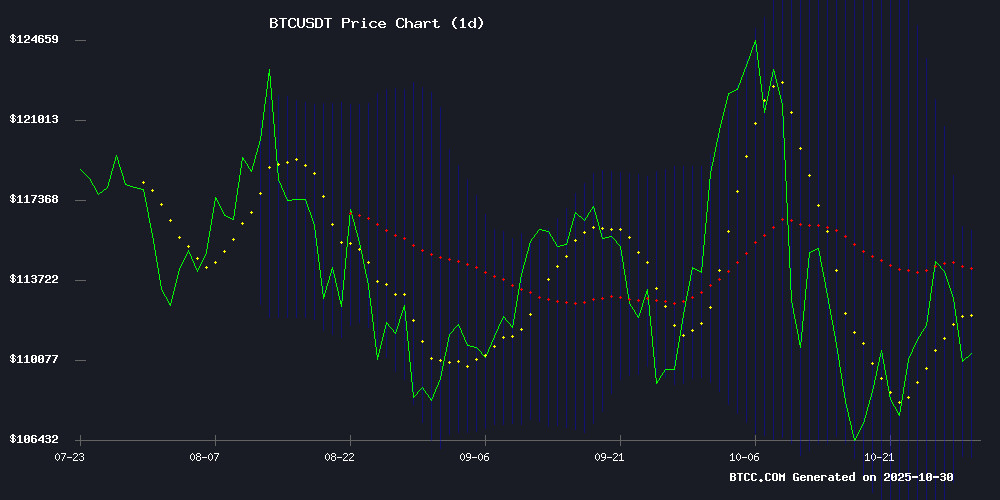

Bitcoin is currently trading at $111,397.94, positioned above its 20-day moving average of $110,856.28, indicating sustained bullish momentum. The MACD indicator shows a reading of 2035.0154, while the signal line stands at 3798.0870, with a negative histogram of -1763.0715 suggesting some near-term consolidation. The Bollinger Bands configuration reveals Bitcoin trading comfortably within the upper band of $116,021.19 and lower band of $105,691.38, with the middle band at $110,856.28 providing dynamic support.

According to BTCC financial analyst Sophia, 'The current technical setup suggests bitcoin maintains its upward trajectory, with the price holding above the critical 20-day MA. The Bollinger Band positioning indicates healthy volatility, while the MACD, despite showing some divergence, doesn't signal a major trend reversal at this stage.'

Market Sentiment: Mixed Signals Amid Fed Decision and Institutional Activity

The cryptocurrency market is experiencing mixed sentiment following the Federal Reserve's 25 basis point rate cut, bringing interest rates to 4%. While Bitcoin initially dipped 2% post-announcement, several fundamental factors suggest underlying strength. Long-term holders have offloaded 325,600 BTC ahead of the Fed decision, potentially creating selling pressure, but this is counterbalanced by significant accumulation from Bitcoin 'dolphins' and emerging institutional interest.

BTCC financial analyst Sophia notes, 'The market is processing multiple conflicting signals. The Fed rate cut typically benefits risk assets like Bitcoin, while the substantial selling from long-term holders indicates profit-taking. However, the Binance reserve ratio suggesting potential supply shock and Germany's progressive stance on Bitcoin adoption provide strong fundamental support for continued price appreciation.'

Factors Influencing BTC's Price

Bitcoin Long-Term Holders Offload 325,600 BTC Ahead of Fed Decision

Bitcoin faces a pivotal moment as long-term holders liquidate 325,600 BTC—the largest monthly divestment since July 2025—while traders brace for Federal Reserve policy signals. Market volatility looms, with the Fed's stance on interest rates poised to dictate near-term momentum.

On-chain data reveals a sustained distribution phase, as veteran investors cash out profits accumulated during earlier accumulation cycles. This capital rotation mirrors historical mid-cycle transitions, where steadfast holders pass the baton to new entrants.

All eyes remain fixed on the Fed's upcoming announcement, which could either reignite bullish momentum or prolong consolidation. Analysts note that Bitcoin's reaction at these demand levels will prove decisive for its next macro move.

Bitcoin Buy Signal Emerges as Binance Reserve Ratio Hints at Supply Shock

Bitcoin is testing key resistance levels ahead of the Federal Reserve's policy decision, with traders anticipating potential volatility across risk assets. The BTC/stablecoin reserve ratio on Binance has triggered a buy signal—a historically accurate precursor to upward price movements.

Market turbulence following the October 10th liquidation event forced Leveraged positions to unwind, creating spillover effects in both derivatives and spot markets. While some investors sought refuge in stablecoins, others viewed the dip as a strategic accumulation opportunity.

Analyst Darkfost notes this marks the third such buy signal during the current market cycle. As Bitcoin consolidates, macro liquidity conditions and institutional positioning may determine the next decisive move.

Germany Pushes for Bitcoin — Could Berlin Be the Next to Adopt BTC?

Germany's political landscape is heating up as bitcoin takes center stage in debates over financial innovation and regulatory independence. The Alternative for Germany (AfD) party has tabled a motion urging the government to exempt Bitcoin from stringent EU regulations under the MiCA framework, positioning it as a unique asset class akin to digital gold.

The proposal highlights Bitcoin's decentralized nature and limited supply, arguing that excessive oversight could drive capital and talent overseas. Lawmakers are pushing to maintain a 12-month tax-free holding period for Bitcoin, signaling a potential shift in how the country views digital assets.

Bitcoin Dolphins Dominate Market with Historic Accumulation

Mid-tier Bitcoin investors, colloquially termed 'Dolphins,' have emerged as the dominant force in the cryptocurrency market. These entities—holding between 100 and 1,000 BTC—now control approximately 26% of the circulating supply, surpassing both retail traders and institutional whales.

On-chain data from Santiment reveals a deliberate accumulation strategy, with Dolphin balances rising steadily since early 2025. The cohort's holdings now stand at 5.16 million BTC, a historic high. Their buying patterns suggest calculated positioning during market consolidations, leveraging minor corrections to bolster reserves.

This sustained accumulation underscores growing institutional-grade confidence in Bitcoin's long-term trajectory. Unlike speculative trading, the Dolphin cohort's behavior reflects a patient, conviction-driven approach—a bullish signal for the broader market.

TeraWulf Proposes $500M Convertible Note Offering for AI Data Center Expansion

TeraWulf, a Bitcoin mining firm, announced a $500 million private offering of convertible senior notes due in 2032, targeting qualified institutional buyers. The company may raise an additional $75 million if initial purchasers exercise their option within a 13-day window starting October 29, 2025.

Proceeds will fund construction of a data center campus in Abernathy, Texas—marking one of TeraWulf's largest U.S. expansions. The project aligns with the company's focus on low-carbon mining and high-performance computing infrastructure, capitalizing on Texas' affordable energy resources.

The MOVE follows a $3.2 billion junk bond deal in the sector, highlighting how AI infrastructure demands are reshaping capital allocation in crypto-adjacent industries. "This isn't just about mining rigs anymore," observed one market analyst. "The convergence of cheap power and AI compute is drawing institutional capital like never before."

Bitcoin Faces Critical Test as Analyst Warns of Potential Cycle Top

Bitcoin's price action has entered a tense consolidation phase, hovering NEAR $113,000 after briefly testing $115,000. Market observers note weakening momentum, fueling debate over whether the rally has peaked or merely paused.

Analyst Sonny (@username) presents a binary outlook: Bitcoin must surge vertically following next week's cycle low to invalidate bearish signals. Failure to do so WOULD confirm the October 6 high of $126,000 as this cycle's peak. The scenario hinges on whether BTC executes an extended fifth Elliott Wave—a final parabolic thrust characteristic of bull market climaxes.

November becomes the make-or-break month. Absent decisive upward movement, Bitcoin risks transitioning into distribution phase territory. Market participants now watch for either confirmation of continuation patterns or early signs of trend exhaustion.

Fed Delivers 25 Basis Point Cut, Rates Now at 4% – BTC to $150k?

The Federal Reserve cut interest rates by 25 basis points to 3.75%-4%, signaling continued economic uncertainty amid a softening labor market. The 10-2 FOMC vote revealed stark divisions, with one member pushing for a deeper cut and another opposing any reduction. This move came despite the federal government shutdown limiting critical data access.

Markets reacted violently, with $300 million liquidated from crypto positions within minutes of Chair Powell's speech. Bitcoin initially plunged but stabilized above $112,000 as traders processed the Fed's dual message of rate cuts coupled with an announced end to quantitative tightening by December 1.

The Bank of Canada mirrored the Fed's move earlier in the day with its own 25-basis-point reduction. Policy makers acknowledged rising employment risks while noting inflationary pressures have intensified since earlier assessments.

Federal Reserve Cuts Interest Rates by 25bps, Bitcoin Dips 2%

The Federal Reserve slashed interest rates by 25 basis points for the second consecutive month, bringing the benchmark lending rate to a three-year low of 3.75%-4%. Chair Jerome Powell emphasized uncertainty in the economic outlook, noting heightened downside risks to employment. Markets reacted swiftly—Bitcoin dropped 2%, while U.S. equities declined amid fading hopes for a December rate cut.

Powell pushed back against expectations of further easing, stating policy remains data-dependent. The ongoing government shutdown has clouded visibility into key metrics like job growth, complicating the Fed's decision-making. Critics, including the TRUMP administration, argue the economy warrants even deeper cuts.

Brazilian Solar Company Explores Bitcoin Mining for Excess Energy Utilization

Thopen, a Brazilian solar energy firm, is evaluating Bitcoin mining as a strategic solution to harness surplus power from the country's expanding renewable energy infrastructure. CEO Gustavo Ribeiro revealed the initiative during an interview with BN Americas, emphasizing diversification as a Core strategy to address energy oversupply challenges.

Brazil's rapid solar and wind capacity growth has outpaced transmission capabilities and local demand, creating financial strain for producers. The government plans to mitigate this through upcoming bidding rounds for hydroelectric and fossil-fuel projects, while private firms like Thopen pivot toward innovative applications like cryptocurrency mining.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, Bitcoin's trajectory toward $200,000 appears plausible but requires sustained momentum and favorable market conditions. The current price of $111,397.94 represents approximately 44% of the way to the $200,000 target.

| Metric | Current Value | Required Movement |

|---|---|---|

| Current Price | $111,397.94 | Base Level |

| 20-Day MA | $110,856.28 | Support Level |

| Price to $200K | 79.5% Increase Needed | +$88,602.06 |

| Bollinger Upper | $116,021.19 | Immediate Resistance |

BTCC financial analyst Sophia explains, 'While $200,000 represents a significant psychological barrier, the combination of technical strength above key moving averages, potential supply shock indicators, and growing institutional adoption creates a favorable environment for continued upward movement. However, investors should monitor the Fed's ongoing policy decisions and market liquidity conditions closely.'